In the lead up to COP26, the role of private finance and the private sector has received considerable attention from global leaders. Private finance can turn billions committed to climate investment through public channels into trillions (Carney and Topping, 2021). The observed number of financial institutions setting net-zero targets has increased fivefold within less than a year, however, a mechanism remains lacking for coordinating efforts between individual private finance institutions (Carney and Topping, 2021). Despite its significance towards boosting global available climate financing, especially in developing countries like Small Island Developing States (SIDS), private finance is not a Blue Zone or main agenda item at the upcoming COP26 negotiations. However, it has been included on the COP Green Zone agenda.

Public sector flows are not expected to sufficiently provide the required funding needed to meet developing countries’ climate finance needs. There have been a number of shortfalls towards achieving the $100 billion commitment by developed countries. Hence, Achievement of net zero ambitions will include a role for not only the $100 billion commitment in public funds by developed countries, but also for the large and untapped pools of private finance.

1. Global Net Zero and COP 26 Priorities for Private Finance

Private finance is by far the biggest and is also a largely untapped pool of capital available for advancing global net zero ambitions (Averchenkova et al., 2020). The prevailing global private finance priorities for climate change can be thematically summed up under seven (7) below main synthesised areas:

Public sector flows are not expected to sufficiently provide the required funding needed to meet developing countries’ climate finance needs. There have been a number of shortfalls towards achieving the $100 billion commitment by developed countries. Hence, Achievement of net zero ambitions will include a role for not only the $100 billion commitment in public funds by developed countries, but also for the large and untapped pools of private finance.

1. Global Net Zero and COP 26 Priorities for Private Finance

Private finance is by far the biggest and is also a largely untapped pool of capital available for advancing global net zero ambitions (Averchenkova et al., 2020). The prevailing global private finance priorities for climate change can be thematically summed up under seven (7) below main synthesised areas:

- Globally aligned standard setting- under a private finance framework (UNEP FI, 2021; Reuters, 2021; Sharma-khushal et al., 2021; SMI, 2021).

- Monitoring and reporting- financial commitments should adhere to clear definitions, metrics, and reporting (Guterres, 2021; UNEP FI, 2021; UNFCCC, 2021; Bank of England, 2021; Kerry, 2021; Quinn, 2021; Carney, 2020).

- Enhanced mobilisation into developing countries- scaling up of green financial instruments (Guterres, 2021). For example, for sustainable infrastructure projects around the world (SMI, 2021; IPCC, 2018) and into developing countries (Carney, 2020).

- Knowledge and best practice sharing- to promote best practices, compare their different initiatives and identify barriers and opportunities of sustainable finance, while respecting national and regional contexts (UNFCCC, 2021; SMI, 2021).

- Returns- measures that help investors to identify viable climate investment opportunities and to transparently report on their investment portfolios (Carney, 2020; Reuters, 2021).

- A deep and liquid global market for carbon credits- encouraging the development of the infrastructure for scaling up high-quality voluntary carbon markets (Guterres, 2021; SMI, 2021).

- Enabling government policy and regulations- government policy that is more predictable (UNFCCC, 2021) across sectors, that helps to lower the risk of low-emission and adaptation investments (IPCC, 2018) and that sets clear market signals for the direction of private financial flows.

2. Global Policy Trends in ESG & Sustainability relevant to SIDS

Photo source: Melissa Joskow/ Media Matters

The IPCC (2018) highlights that alongside the provision of public funds, government policies will play an important facilitatory role in the mobilisation of private funds thus enhancing the effectiveness of other public policies.

Increasing Net Zero Standards & A Growing Private Sector ResponseGovernments of developed countries have increasingly begun to introduce net zero standards for reporting climate risks and opportunities. For example, in June 2021, the G7 announced their backing to make climate risk disclosure mandatory according to the existing recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD). Private sector companies in these countries are in turn expected to and have begun setting their own net zero targets and private finance companies are coming together to set industry standards via global networks such as GFANZ (Carney, 2020). Overall, improved reporting, risk management and measures in developed countries are expected to benefit developing countries, but it is not yet clearly indicated how (Carney, 2020).

Geopolitical Developments & Climate finance de-risking platformsThe COP 26 Finance Hub recognised international private financial flows as critical to supporting the financing gap in developing countries. However, it also acknowledged that the necessary private financial flows to developing countries were still limited (Carney, 2020).

In response to China’s Belt and Road Initiative (BRI- which in recent years has shown significantly declining investment trends), the G7 in June 2021 announced its ‘Build Back Better World (B3W)’ initiative as an alternative to the BRI to help narrow the $40+ trillion infrastructure need in developing countries, including in SIDS (The White House, 2021). The initiative involves catalysing private capital to invest in global infrastructure. Climate forms one of the B3W’s four core focus areas (CSIS, 2021).

Climate finance de-risking platforms offer another potential source of much needed resources for supporting developing countries’ transition. These blend private and public finance and have the potential to offer the scale of investments at the pace needed in SIDS when coupled with an enabling policy and regulatory environment (UNDP, 2017). For example, the SDG Investor Platform launched in April 2021 (UNDP, 2021).

The Implications for SIDS?The above developments raise the key question: what implications will trends in global green policy, ESG and Sustainability have on SIDS’ trade and private sector green transition?

In this regard, future research and discussion is strongly recommended which:

Sources:

Photo source: Melissa Joskow/ Media Matters

The IPCC (2018) highlights that alongside the provision of public funds, government policies will play an important facilitatory role in the mobilisation of private funds thus enhancing the effectiveness of other public policies.

Increasing Net Zero Standards & A Growing Private Sector ResponseGovernments of developed countries have increasingly begun to introduce net zero standards for reporting climate risks and opportunities. For example, in June 2021, the G7 announced their backing to make climate risk disclosure mandatory according to the existing recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD). Private sector companies in these countries are in turn expected to and have begun setting their own net zero targets and private finance companies are coming together to set industry standards via global networks such as GFANZ (Carney, 2020). Overall, improved reporting, risk management and measures in developed countries are expected to benefit developing countries, but it is not yet clearly indicated how (Carney, 2020).

Geopolitical Developments & Climate finance de-risking platformsThe COP 26 Finance Hub recognised international private financial flows as critical to supporting the financing gap in developing countries. However, it also acknowledged that the necessary private financial flows to developing countries were still limited (Carney, 2020).

In response to China’s Belt and Road Initiative (BRI- which in recent years has shown significantly declining investment trends), the G7 in June 2021 announced its ‘Build Back Better World (B3W)’ initiative as an alternative to the BRI to help narrow the $40+ trillion infrastructure need in developing countries, including in SIDS (The White House, 2021). The initiative involves catalysing private capital to invest in global infrastructure. Climate forms one of the B3W’s four core focus areas (CSIS, 2021).

Climate finance de-risking platforms offer another potential source of much needed resources for supporting developing countries’ transition. These blend private and public finance and have the potential to offer the scale of investments at the pace needed in SIDS when coupled with an enabling policy and regulatory environment (UNDP, 2017). For example, the SDG Investor Platform launched in April 2021 (UNDP, 2021).

The Implications for SIDS?The above developments raise the key question: what implications will trends in global green policy, ESG and Sustainability have on SIDS’ trade and private sector green transition?

In this regard, future research and discussion is strongly recommended which:

- Explores ways to ensure that the private sector in SIDS is not left behind or made worse off, whether inadvertently or otherwise, and that

- Explores in greater detail how the measures, incentives and platforms that encourage green investment by private finance entities and the private sector will lead to the required investment flows in SIDS’ decarbonisation.

Sources:

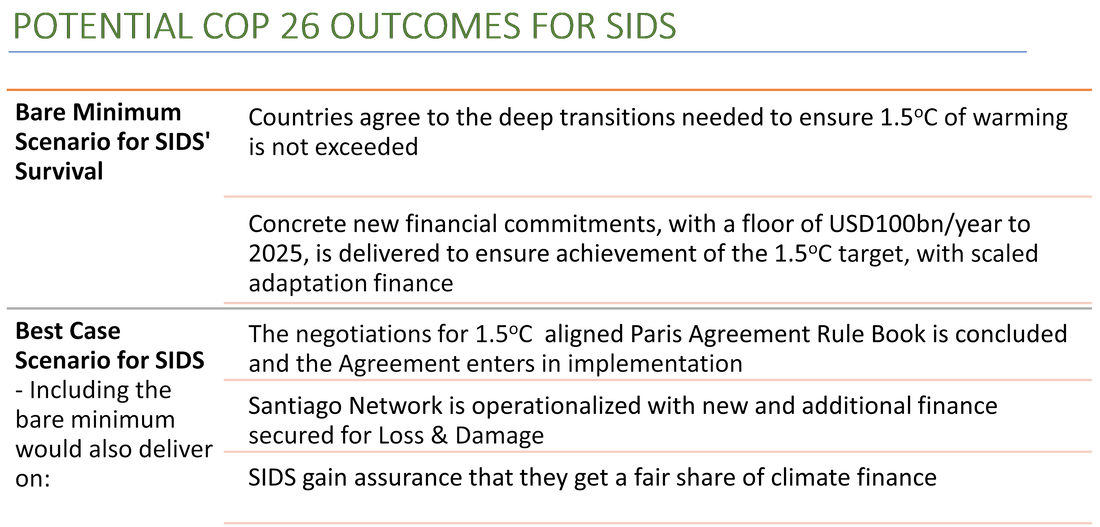

The current emissions reduction policies are not sufficient to secure a climate safe future for all, and in fact will lead to devastating impacts for SIDS. Time is running out, only through bold and collective action can COP26 secure such a future.

For the Survival of Small Island Developing States (SIDS), countries which are on the frontline of the impacts of climate change, COP 26 must deliver a scenario that at minimum delivers on the 1.5oC commitment and that guarantees their green finance needs are finally met.

For the Survival of Small Island Developing States (SIDS), countries which are on the frontline of the impacts of climate change, COP 26 must deliver a scenario that at minimum delivers on the 1.5oC commitment and that guarantees their green finance needs are finally met.

In order to achieve at least the bare minimum best outcome at COP26 for SIDS, we recommend several strategic actions or positionings by SIDS’ negotiators and other relevant participating actors.

1. Key strategic positions for SIDS to be presented across every coalition that SIDS form

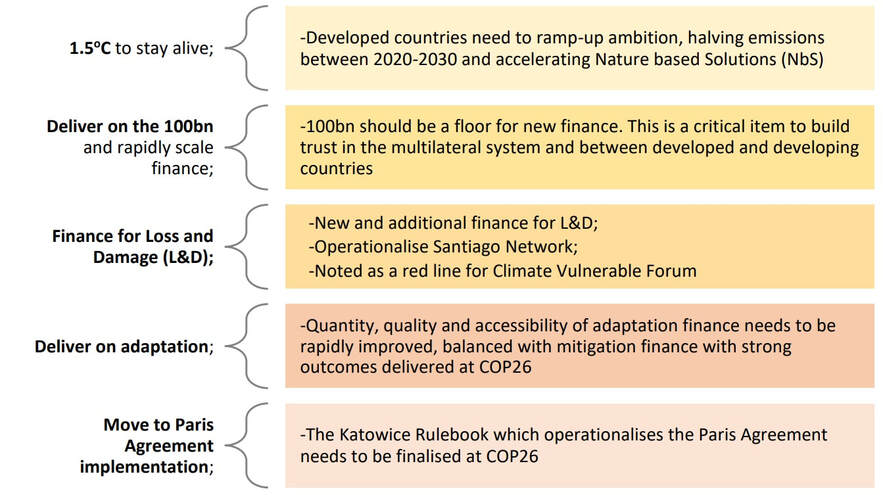

High Level messaging from leaders at Leaders’ Summit to G20 and major pollutersCOP26, is the last good moment for the World to stay within 1.5oC. Current submitted NDCs are insufficient. They do not bring us close to the temperature goal of 2oC, let alone 1.5oC which the scientific community has made clear is the only least bad option available for all countries. This will still be devastating for SIDS, any increment above 1.5oC now has an additional instrument in the form of the new Human Right to a safe, clean, healthy and sustainable environment through which to be challenged. Hence, every decision and conclusion made need to be 1.5oC compatible. If it is not, COP26 will without compromise, be declared a failure. Leaders can request a declaration on whether submitted NDCs are in line with a 1.5oC pathway. If they are not, the new 1.5oC aligned NDCs need to be submitted before the five-year ambition ratcheting mechanism.

Additionally, common but differentiated responsibilities need to be upheld with historic polluters accelerating efforts beyond the targets they have indicated. Furthermore, climate finance needs to be accessible and rapidly scaled, with adaptation finance being beyond 50% share of available climate finance. The UNEP Adaptation Gap Report quantified the cost of adaptation for developing countries in 2030 to be between USD140-300bn as such adaptation finance needs to grow exponentially. A portion of climate finance needs to be referenced for SIDS to ensure that SIDS, with their special circumstances, get a fair share. Also noting the debt burden of SIDS is unsustainable to address development and climate change adaptation - whilst this is not under the mandate of the UNFCCC process, it is important that any decision on finance considers the special circumstances of SIDS and the macroeconomic conditions they are exposed to which will hinder their ability to access the significant financial resources necessary to address climate change impacts. There is value for making such a case at COP as any favourable decision achieved here can provide weighting for concessions in other negotiations spaces such as the IMF.

Another critical area for SIDS is Loss and Damage (L&D). This must deliver by at the very least operationalizing the Santiago Network. In addition, it must be reiterated that L&D is not adaptation, but separate and distinct. Also important is the need for all elements of the Paris Agreement Rulebook to be finalised and aligned with 1.5oC – the substantial elements are Article 6, Common Timeframes, Enhanced Transparency Framework.

Negotiator level positions on the more nuanced elements of the Paris Agreement

1. Key strategic positions for SIDS to be presented across every coalition that SIDS form

High Level messaging from leaders at Leaders’ Summit to G20 and major pollutersCOP26, is the last good moment for the World to stay within 1.5oC. Current submitted NDCs are insufficient. They do not bring us close to the temperature goal of 2oC, let alone 1.5oC which the scientific community has made clear is the only least bad option available for all countries. This will still be devastating for SIDS, any increment above 1.5oC now has an additional instrument in the form of the new Human Right to a safe, clean, healthy and sustainable environment through which to be challenged. Hence, every decision and conclusion made need to be 1.5oC compatible. If it is not, COP26 will without compromise, be declared a failure. Leaders can request a declaration on whether submitted NDCs are in line with a 1.5oC pathway. If they are not, the new 1.5oC aligned NDCs need to be submitted before the five-year ambition ratcheting mechanism.

Additionally, common but differentiated responsibilities need to be upheld with historic polluters accelerating efforts beyond the targets they have indicated. Furthermore, climate finance needs to be accessible and rapidly scaled, with adaptation finance being beyond 50% share of available climate finance. The UNEP Adaptation Gap Report quantified the cost of adaptation for developing countries in 2030 to be between USD140-300bn as such adaptation finance needs to grow exponentially. A portion of climate finance needs to be referenced for SIDS to ensure that SIDS, with their special circumstances, get a fair share. Also noting the debt burden of SIDS is unsustainable to address development and climate change adaptation - whilst this is not under the mandate of the UNFCCC process, it is important that any decision on finance considers the special circumstances of SIDS and the macroeconomic conditions they are exposed to which will hinder their ability to access the significant financial resources necessary to address climate change impacts. There is value for making such a case at COP as any favourable decision achieved here can provide weighting for concessions in other negotiations spaces such as the IMF.

Another critical area for SIDS is Loss and Damage (L&D). This must deliver by at the very least operationalizing the Santiago Network. In addition, it must be reiterated that L&D is not adaptation, but separate and distinct. Also important is the need for all elements of the Paris Agreement Rulebook to be finalised and aligned with 1.5oC – the substantial elements are Article 6, Common Timeframes, Enhanced Transparency Framework.

Negotiator level positions on the more nuanced elements of the Paris Agreement

Under Article 6 of the Paris Agreement remains the need to finalize robust carbon markets and a rulebook that ensures environmental integrity consistent with 1.5oC. This is important in order to unlock new finance streams. In addition, the carbon markets regime should raise at least 5% proceeds to support the adaptation actions of developing countries particularly vulnerable to climate change. A need also exists to ensure that the rules of Article 6 lead us to 1.5oC with transparent involvement of the private sector. There is untapped potential for private finance to better and more innovatively incorporate the interests of SIDS. Developed countries should advance policies that more proactively encourage mutually beneficial green investments in SIDS’ markets. For instance, net zero public policy ideas compatible with existing frameworks such as the UK’s and EU’s Green Deal, can be incorporated by developed countries to stimulate developed country companies to invest in SIDS’ decarbonisation across the supply chain, as well as to invest in suitably and specifically outlined priority areas of Loss and Damage.

An enhanced transparency framework is also important. Modalities, procedures, and guidelines had been largely concluded at COP24. The remaining work to operationalise the Enhanced Transparency Framework is highly technical in nature and needs to be coordinated with Article 6 of the negotiations and its treatment of corresponding adjustments.

Loss and Damage has been repeatedly highlighted as an important area for SIDS and other most climate vulnerable countries such as the Climate Vulnerable Forum (CVF) and the Vulnerable 20 Group (V20). It is therefore crucial that L&D is devoted the necessary discussion space as part of the COP/CMA agenda. Ideally, all arrangements for the Santiago Network on Loss and Damage agreed at COP25 should be made operational at COP26. Specifically, the Santiago Network needs to address L&D at the technical and financial level, as well as a governance mechanism to address slow onset events separately. In addition, New and additional finance for L&D is being called for as is a call for a L&D envoy to be appointed by the COP26 Presidency and the UNSG to carry the discussion beyond CO26. A request is to have L&D addressed as a plenary issue every year. There is also a need for solidarity beyond insurance.

Another key focus would be finalising common timeframes for nationally determined contributions (NDCs). Eight options are on the table to be considered at the upcoming Subsidiary Bodies session with agreement to be reached on the length of the time frame, how it applies to developed and developing countries, and its synergy with other processes under the Agreement including the global stocktake and climate finance replenishment cycles. Important here is that the timeframe avoids locking in low ambition.

2. Advancement of SIDS’ Private Finance Negotiating Agenda outside the COP Blue Zone

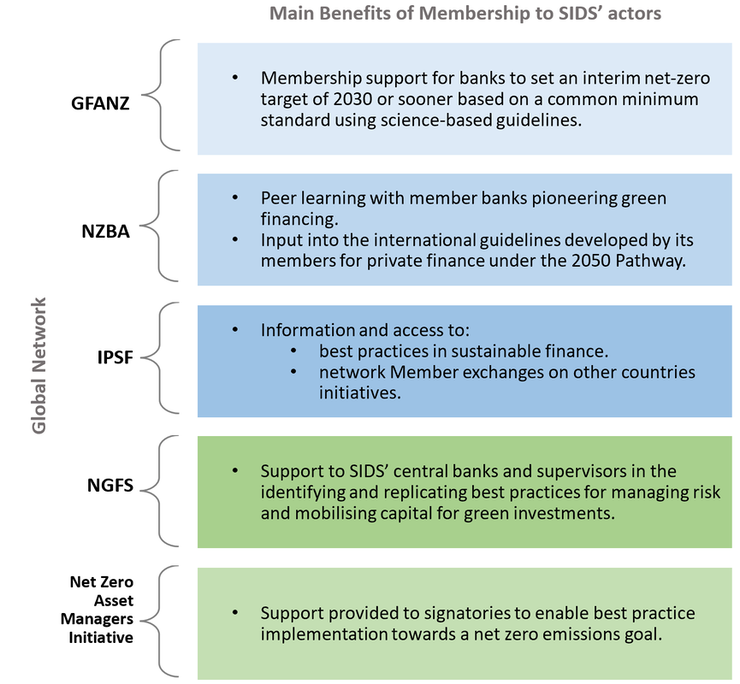

Developed and large developing country actors are moving ahead to set the private finance framework outside the main negotiating COP arena. SIDS need to also strategically position themselves so that they ensure a say in its development. More SIDS should join relevant global platforms/ networks shaping the new global norms in private finance. For example, the International Platform on Sustainable Finance (IPSF). The IPSF aims to scale up the mobilisation of private capital towards environmentally sustainable investments. The network consists of SIDS’ major developed country trading partners such as the European Union (EU), the United Kingdom (UK) and Canada. However, currently no SIDS are members of the IPSF. Other relevant networks include: the Glasgow Financial Alliance for Net Zero (GFANZ), the UN-Convened industry-led Net-Zero Banking Alliance (NZBA- a sub-network of GFANZ), the Network for Greening the Financial System (NGFS), and the Net Zero Asset Managers Initiative.

An enhanced transparency framework is also important. Modalities, procedures, and guidelines had been largely concluded at COP24. The remaining work to operationalise the Enhanced Transparency Framework is highly technical in nature and needs to be coordinated with Article 6 of the negotiations and its treatment of corresponding adjustments.

Loss and Damage has been repeatedly highlighted as an important area for SIDS and other most climate vulnerable countries such as the Climate Vulnerable Forum (CVF) and the Vulnerable 20 Group (V20). It is therefore crucial that L&D is devoted the necessary discussion space as part of the COP/CMA agenda. Ideally, all arrangements for the Santiago Network on Loss and Damage agreed at COP25 should be made operational at COP26. Specifically, the Santiago Network needs to address L&D at the technical and financial level, as well as a governance mechanism to address slow onset events separately. In addition, New and additional finance for L&D is being called for as is a call for a L&D envoy to be appointed by the COP26 Presidency and the UNSG to carry the discussion beyond CO26. A request is to have L&D addressed as a plenary issue every year. There is also a need for solidarity beyond insurance.

Another key focus would be finalising common timeframes for nationally determined contributions (NDCs). Eight options are on the table to be considered at the upcoming Subsidiary Bodies session with agreement to be reached on the length of the time frame, how it applies to developed and developing countries, and its synergy with other processes under the Agreement including the global stocktake and climate finance replenishment cycles. Important here is that the timeframe avoids locking in low ambition.

2. Advancement of SIDS’ Private Finance Negotiating Agenda outside the COP Blue Zone

Developed and large developing country actors are moving ahead to set the private finance framework outside the main negotiating COP arena. SIDS need to also strategically position themselves so that they ensure a say in its development. More SIDS should join relevant global platforms/ networks shaping the new global norms in private finance. For example, the International Platform on Sustainable Finance (IPSF). The IPSF aims to scale up the mobilisation of private capital towards environmentally sustainable investments. The network consists of SIDS’ major developed country trading partners such as the European Union (EU), the United Kingdom (UK) and Canada. However, currently no SIDS are members of the IPSF. Other relevant networks include: the Glasgow Financial Alliance for Net Zero (GFANZ), the UN-Convened industry-led Net-Zero Banking Alliance (NZBA- a sub-network of GFANZ), the Network for Greening the Financial System (NGFS), and the Net Zero Asset Managers Initiative.

Advancing A Strategic Private Finance and Private Sector Agenda Beyond COP26

Beyond the negotiating arena of COP, prioritisation should be made on exploring how to ensure SIDS’ private sector is not left behind or inadvertently made worse off by the evolving global private finance framework. Secondly, prioritisation should also be made on exploring exactly how the measures, incentives and platforms that encourage/ will encourage green investment by private finance entities and the private sector will lead to the required investment flows in SIDS’ decarbonisation. Thirdly, prioritisation should be made on determining how the ongoing work of organisations such as the UNFCCC’s Standing Committee on Finance (SCF), the Green Climate Fund (GCF), the SDG Investor Platform, B3W etc., can better serve SIDS’ specific interests via increased mobilisation of private finance. For example, under the GCF’s Private Sector Facility actions related to loss and damage have been financed.

Sources:

Sharma-Khushal, S., Laurent, E., & Greene-Dewasmes, G., 2021. Survival of Small Islands: Will COP26 Deliver? iDERA.

Greene-Dewasmes, G., Laurent, E., & Sharma-Khushal, S., 2021. The Crucial Role of Private Finance and the Private Sector in SIDS’ Green Transition: The COP26 Agenda and Beyond. iDERA.

Beyond the negotiating arena of COP, prioritisation should be made on exploring how to ensure SIDS’ private sector is not left behind or inadvertently made worse off by the evolving global private finance framework. Secondly, prioritisation should also be made on exploring exactly how the measures, incentives and platforms that encourage/ will encourage green investment by private finance entities and the private sector will lead to the required investment flows in SIDS’ decarbonisation. Thirdly, prioritisation should be made on determining how the ongoing work of organisations such as the UNFCCC’s Standing Committee on Finance (SCF), the Green Climate Fund (GCF), the SDG Investor Platform, B3W etc., can better serve SIDS’ specific interests via increased mobilisation of private finance. For example, under the GCF’s Private Sector Facility actions related to loss and damage have been financed.

Sources:

Sharma-Khushal, S., Laurent, E., & Greene-Dewasmes, G., 2021. Survival of Small Islands: Will COP26 Deliver? iDERA.

Greene-Dewasmes, G., Laurent, E., & Sharma-Khushal, S., 2021. The Crucial Role of Private Finance and the Private Sector in SIDS’ Green Transition: The COP26 Agenda and Beyond. iDERA.